(PRESS RELEASE)PADUA — The Board of Directors of Safilo Group S.p.A. has approved the Company’s consolidated financial statements for the year ended December 31, 20201 and examined the separate financial statements for the year ended December 31, 20201, which will be submitted for approval by the shareholders at the Annual General Meeting to be held in a single call on April 29, 2021.

The Board of Directors has decided not to propose the payment of a dividend to the next Annual General Meeting.

Angelo Trocchia, Safilo’s chief executive officer, commented:

“2020 presented the most challenging market conditions we have ever experienced and I want to express my utmost gratitude to all our people, in the plants and in our offices around the world, for their dedication and the excellent job accomplished in such a difficult period of our lives.

The health and safety of our people, including the opportunity to manage professional and personal needs with the greatest flexibility, were and continue to be our first priority.

I am proud of the work done by our organization to advance our medium-term strategic agenda, and considering the unprecedented market conditions, I am satisfied with our ability to contain, as much as possible, the impact to our top and bottom line.

Advertisement

In 2020 our net sales fell by 15.2% at constant exchange rates and the adjusted EBITDA finished slightly positive, reflecting the significant Covid-19 impact suffered in the first half of the year followed by a solid sales recovery in the second half, and our decisive interventions on the cost structure. In 2020, we were able to deliver 15 million euros of structural overhead savings, already bringing home the majority of the 20 million targeted in our medium-term Plan, coupled with an effective use of the supports made available by governments throughout this pandemic.

We also worked strenuously to maintain a sound financial profile, securing additional liquidity for the Group with a new guaranteed term loan facility, and handling, to the best of our abilities, our net working capital requirements through a prudent reduction of our inventories and an effective and balanced management of our cash collection and payments activities.

I want to thank our partners, clients and suppliers, for their support, as together we continued building a more sustainable business in such a crucial year.

Q4 reflected again a more challenging marketplace, as fresh restrictions were imposed above all in Europe to contain the second wave of the pandemic. In such a still complex environment, we are therefore particularly pleased with our positive finish to the year, which we think confirms the strategic directions we set out at the end of 2019 and the business priorities we gave ourselves to accomplish our Plan.

In the last three months of the year, our net sales grew by +3.0% at constant exchange rates behind the sequential improvement, quarter on quarter, of our wholesale2 activities, thanks again to the strength of our North American market, where we kept leveraging on the capabilities we built to better serve our customers in the independent opticians channel. In Q4, the United States were thus a key growth driver, which together with the strong business rebound we experienced in China and Australia, allowed us to almost fully offset the impact of the challenging market environment in Europe and in a number of emerging countries.

In a year in which e-commerce and social digital marketing leapfrogged in consumer relevance, the significant progress of Smith’s direct-to-consumer business and the acquisitions of Privé Revaux in February and of Blenders Eyewear in June, gave a strong boost to the digital transformation strategy we announced in December 2019, representing a meaningful support to the recovery we posted in the second half of the year. Our H2 net sales grew by 4.5% at constant exchange rates and the adjusted Ebitda increased by 21%.

Advertisement

Our total online business grew sharply in 2020, contributing around 100 million euros or 13% to our Group’s net sales, from around 4% in 2019, a clear strategic choice we took before the outset of the pandemic and which we invested in during the year, alongside the significant focus we put on strengthening the partnership with our clients through a brand new B2B platform and CRM system, all improving the customer engagement and enhancing our product offer and service levels.

In 2020, we continued to renew our portfolio, launching four new brands during the year, Levi’s, David Beckham, Missoni and Ports, and getting ready for the launch of Isabel Marant and Under Armour at the beginning of 2021.

Last year, we also started our production footprint overhaul, to realign the Group’s manufacturing capacity to the current and future production needs, selling the Martignacco site at the beginning of October and starting the reorganization of the Longarone plant.

Considering the challenging market scenarios due to the pandemic we are still dealing with, we are now required to take further steps in the direction of our Plan to have a more efficient and competitive industrial footprint, in particular with reference to the declared intention to start a process for the closure of the Slovenia factory in Ormoz. This is for us a very painful choice, dictated by an already complex situation, which has become structural and no longer sustainable, and on which we will be fully committed to identifying, in collaboration with the local trade unions and authorities, all possible solutions to mitigate its social impacts.

The business environment at the beginning of 2021 remained affected by the containment actions still in place in many countries to halt the spread of Covid-19 and the uncertainties over the scale and timing of the expected rebound in consumer demand across the different geographies. Our business activity in January and February was in line with our expectations for a more moderate start to the year compared to the very positive sales trends recorded at the beginning of 2020, while the first ten days of March confirm a significant acceleration compared to the same period last year, the first to be highly impacted by the consequences of the pandemic.

Sales performance in these months continued to be influenced by the positive business trends in the United States, the ongoing strength of the online channel and a more marked recovery in emerging markets, while a number of countries in Europe and the travel retail business in Asia remain weak spots.

Advertisement

As we continue to maintain a prudent stance on the prospects for the current year awaiting further market evidence of a solid sun season, the main assumption of our work today rests on the opportunity for our business, both owned and licensed, to effectively compensate for discontinued and exiting activities, and on the continuation of our cost reduction plan to recover this year a more positive economic profile.”

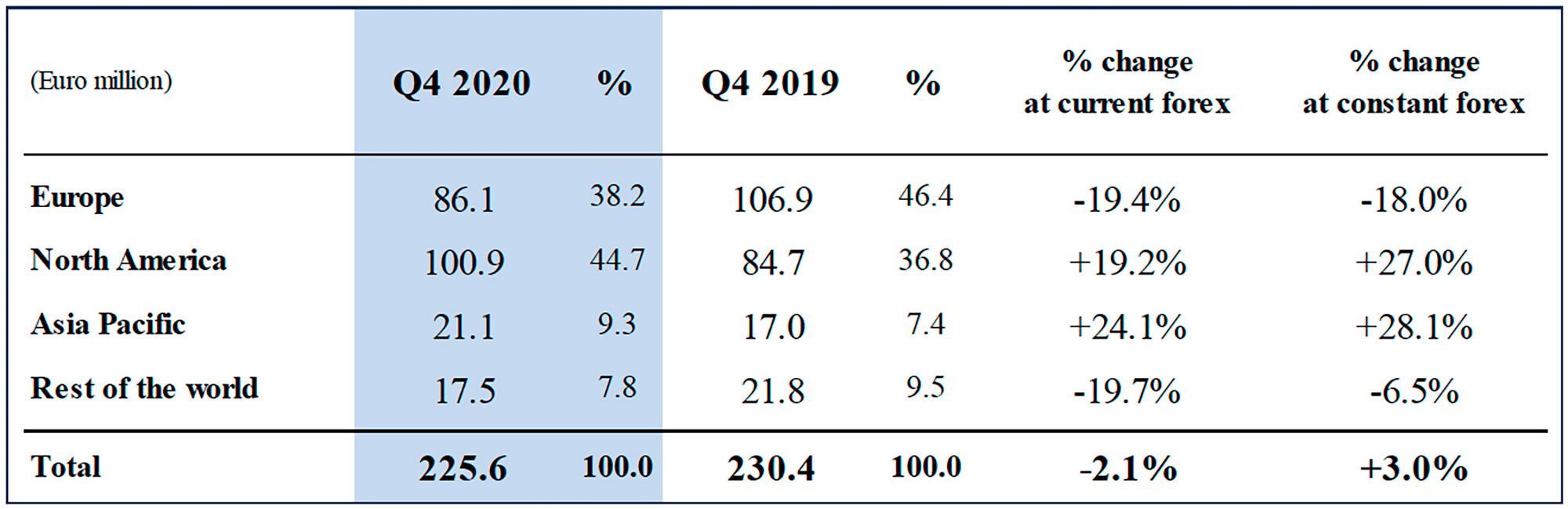

Net sales performance in Q4 2020

In the fourth quarter of 2020, Safilo posted total net sales of Euro 225.6 million, up 3.0% at constant exchange rates and down 2.1% at current exchange rates compared to Euro 230.4 million posted in the fourth quarter of 2019.

The positive sales performance reflected the contribution to the Group’s North American business of the recent acquisitions of Privé Revaux and Blenders Eyewear, for a total of Euro 14.1 million, and the sequential improvement of Safilo’s organic business, down 3.6% at constant exchange rates, and almost flat at the wholesale2 business level, at -1.6% at constant exchange rates from -33.2% in H1 and -5.5% in Q3 2020.

The progress of Safilo’s total online sales was again very significant in Q4, standing at around 12% of the Group’s net sales from around 4.5% in the same period of 2019, thanks to the fast growing e-com activities of the recent acquisitions and to an organic online sales growth of +60.9% at constant exchange rates, driven by Smith’s D2C channel and by the Group’s sales generated through internet pure players.

The drivers by geography of the Group net sales performance in Q4 2020 were:

- The confirmed rebound of the North American business, up 8.9% on an organic basis excluding the acquisitions and at constant exchange rates. Q4 total net sales in North America were instead up 27.0% at constant exchange rates and 19.2% at current exchange rates, thanks to the contribution, seasonally more moderate than in the previous two quarters, of Privé Revaux and Blenders Eyewear;

- The still weak market environment in Europe, where net sales in Q4 2020 fell by 18.0% at constant exchange rates (-16.0% at the wholesale2 business level) and 19.4% at current exchange rates, due to the reintroduction of varying restrictions to people’s mobility and commercial activities following the second wave of coronavirus infections. Lockdowns and lack of tourism affected in particular specialty channels like boutiques and travel retail, whereas sales generated through internet pure players continued to register strong progress. The quarter also showed the recovery in order taking and wholesale activity from big chains;

- The meaningful growth of Asia Pacific, with the quarterly net sales up 28.1% at constant exchange rates and 24.1% at current exchange rates, from -6.4% in Q3 2020, thanks to the strong acceleration recorded by the Chinese business, more than tripled in Q4 2020, and to a significant sales acceleration also in Australia;

- The milder sales contraction in the Rest of the World, down 6.5% at constant exchange rates and -19.7% at current exchange rates, driven by the positive performance in the quarter of Brazil and Mexico and the first signs of a recovery materializing also in the Middle East countries.

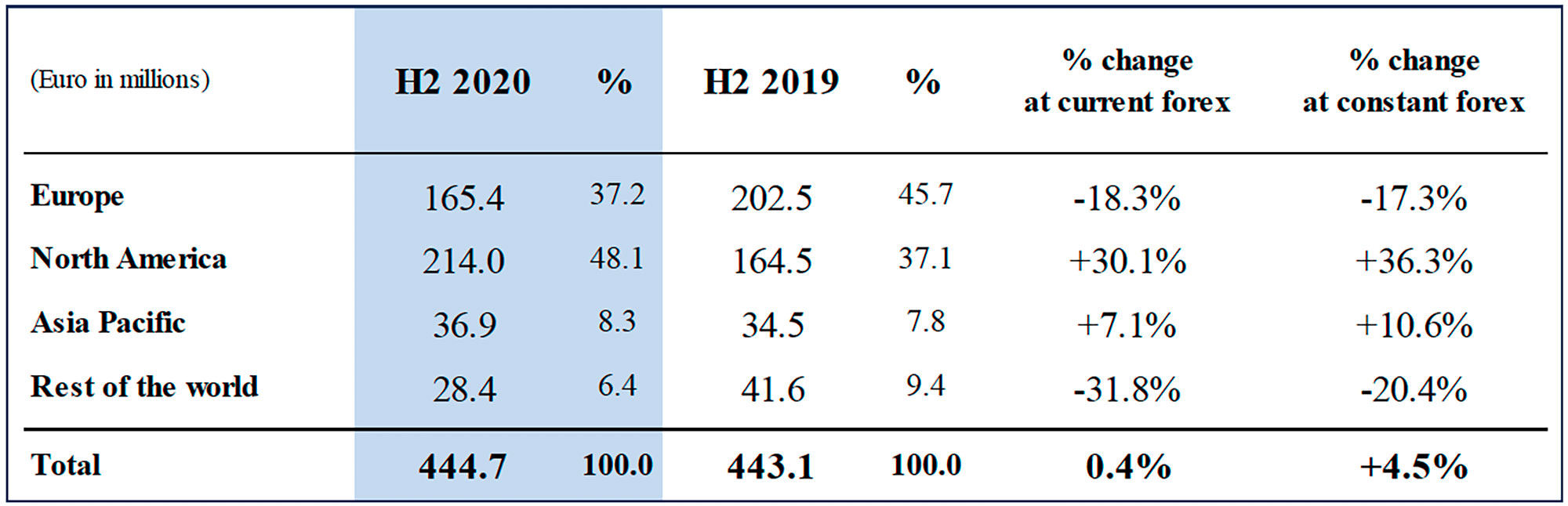

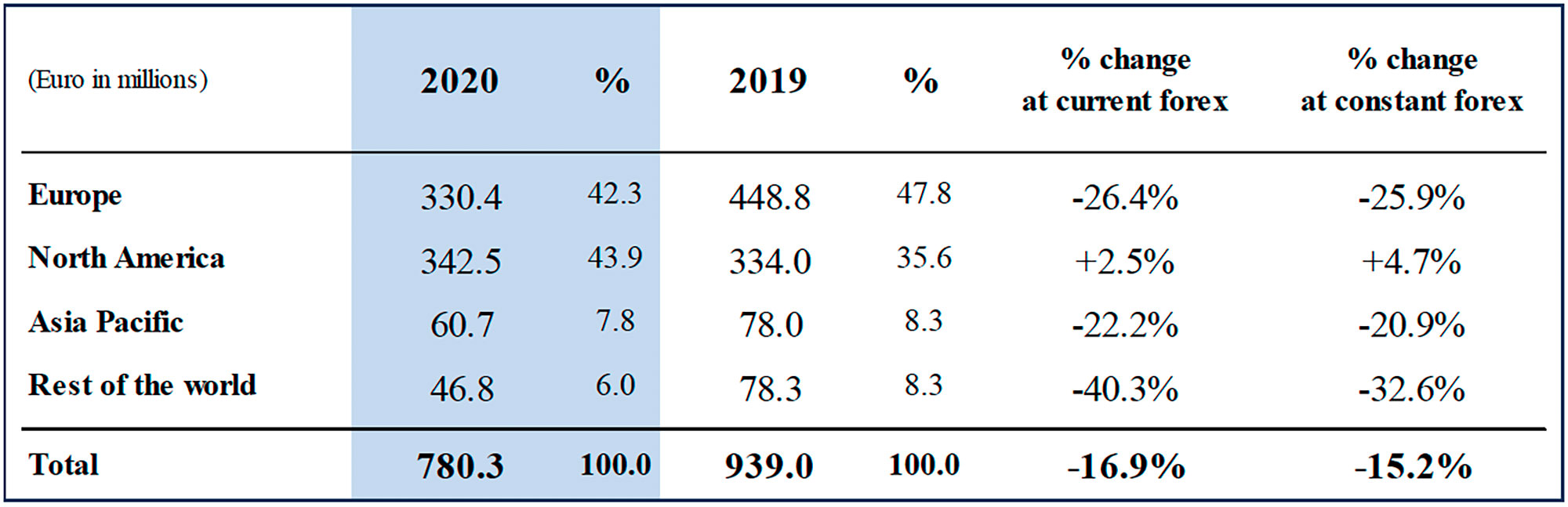

Net sales performance in full year and in H2 2020

Safilo closed 2020 with net sales of Euro 780.3 million, down 15.2% at constant exchange rates and 16.9% at current exchange rates compared to Euro 939.0 million recorded in 2019, due to the sharp decline suffered in the first half of the year following the severe lockdowns put in place by governments globally to fight the Covid-19 pandemic. The business rebound recorded by the Group in the third quarter, followed by the positive net sales performance achieved in the fourth quarter allowed Safilo to post an H2 2020 net sales growth of +4.5% at constant exchange rates, +0.4% at current exchange rates, reaching Euro 444.7 million compared to Euro 443.1 million in the second half of 2019.

In 2020, Safilo’s organic business, excluding the acquisitions, declined by 21.9% at constant exchange rates, -21.5% at the wholesale2 business level, while the contribution of the newly acquired Blenders Eyewear and Privé Revaux equalled Euro 61.8 million for the full period of consolidation, with the two businesses together growing by +66% on a pro-forma performance basis4, thanks to the surge of their e-com activities. In 2020, Safilo’s total online sales, including acquisitions, almost tripled compared to 2019, accounting for around 13% of the Group’s total net sales, from around 4% in the previous year.

Group net sales performance by geography in H2 2020

2020 total sales in North America grew +4.7% at constant exchange rates, after jumping +36.3% in H2 as a result of the full contribution of the acquisitions, and of the organic business rebound of +10.6% at constant exchange rates. The latter positive performance was underpinned by the solid recovery experienced by the Group in the independent optical stores and by the strength of the Smith products in the sports and direct-to-consumer channels. After a very difficult first half of the year, in 2020 the North American organic business declined less than all other geographies, down 14.2% at constant exchange rates;

Group net sales performance by geography in FY 2020

2020 sales in Europe were down 25.9% at constant exchange rates, as trading activities remained weak also in the second half of the year, at -17.3%, due to a subdued summer season affecting the sunglass business in Q3 and the second wave of Covid-19 infections undermining the recovery in Q4;

2020 sales in Asia Pacific were down 20.9% at constant exchange rates, with the sales contraction almost entirely explained by the drastic drop of the travel retail business due to the extensive bans on travel in the year. In the second half of 2020, sales performance in Asia Pacific rebounded, up +10.6% at constant exchange rates, thanks to a surging

business in China and in Australia;

2020 sales in the Rest of the World were down 32.6% at constant exchange rates, reflecting the very difficult health environment which characterized the IMEA and Latin America countries for the first nine months of the year, with the first signs of a recovery materializing only in the fourth quarter.

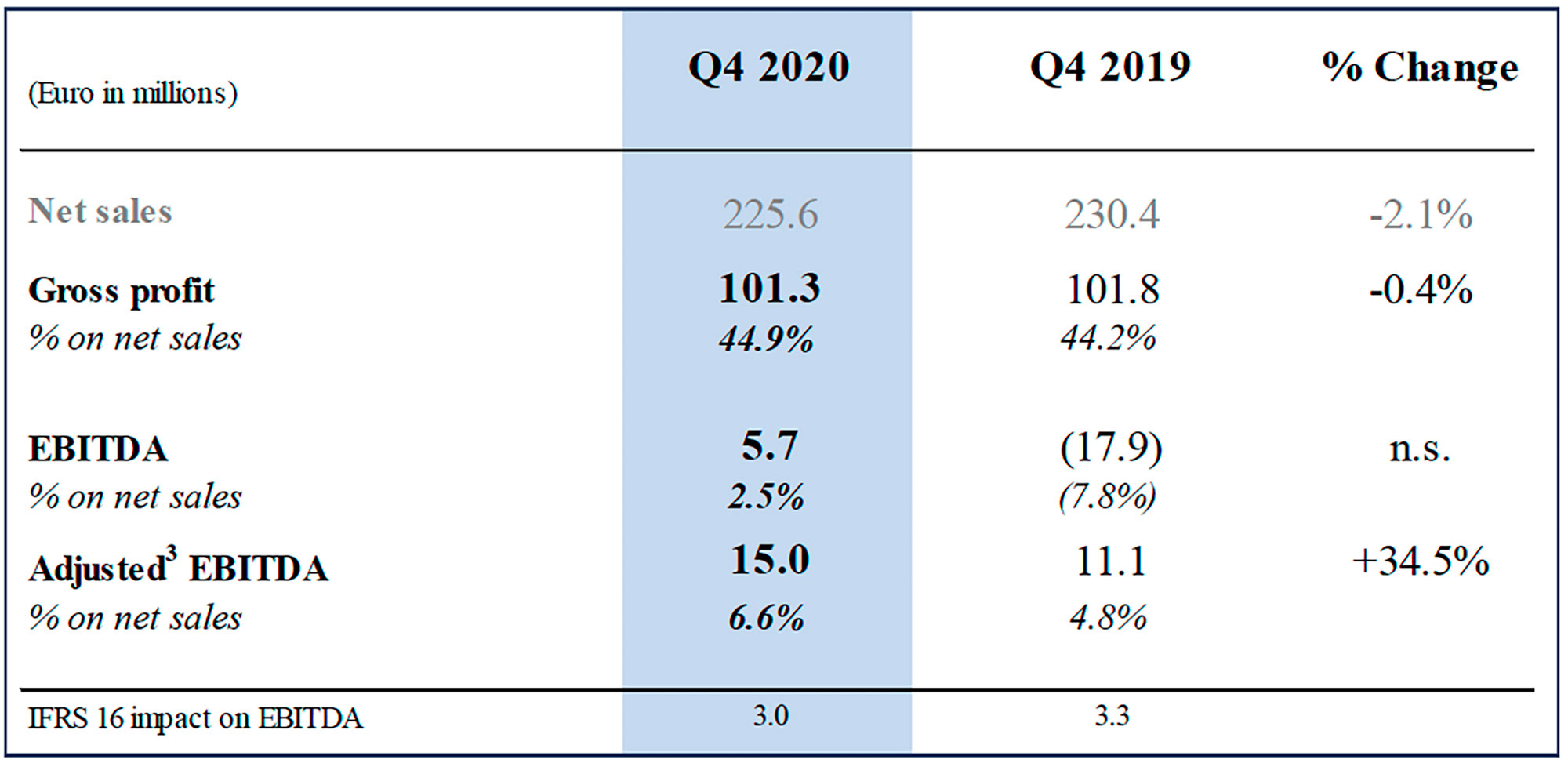

Economic performance in Q4 2020

Net sales performance in Q4 2020 allowed the Group to continue the recovery of earnings started in the third quarter, registering a positive adjusted EBITDA of Euro 15.0 million, up 34.5% compared to the Euro 11.1 million in Q4 2019. In Q4 2020, the adjusted EBITDA margin increased to 6.6% of sales from 4.8% in Q4 2019, a 180 basis-point

improvement which mainly reflected the improved operating leverage in the period.

Economic performance in full year and in H2 2020

Safilo’s 2020 economic results finally reflected on one side the unprecedented drop of sales and economic fallout in the first half of the year due to the drastic reduction of worldwide business activities which followed the outbreak and spread of the Covid-19 pandemic, on the other the positive business recovery achieved by the Group in the second half of the year, notwithstanding a market environment which remained in many cases highly constrained.

In the year, Safilo achieved structural overheads costs savings of Euro 15 million, marking a significant progress in relation to the Group’s medium-term plan for a total Euro 20 million overheads cost reduction. The contingency measures in relation to the Covid-19 emergency resulted instead in a one-time saving estimated at Euro 28 million, mainly reflecting applicable personnel relief programs.

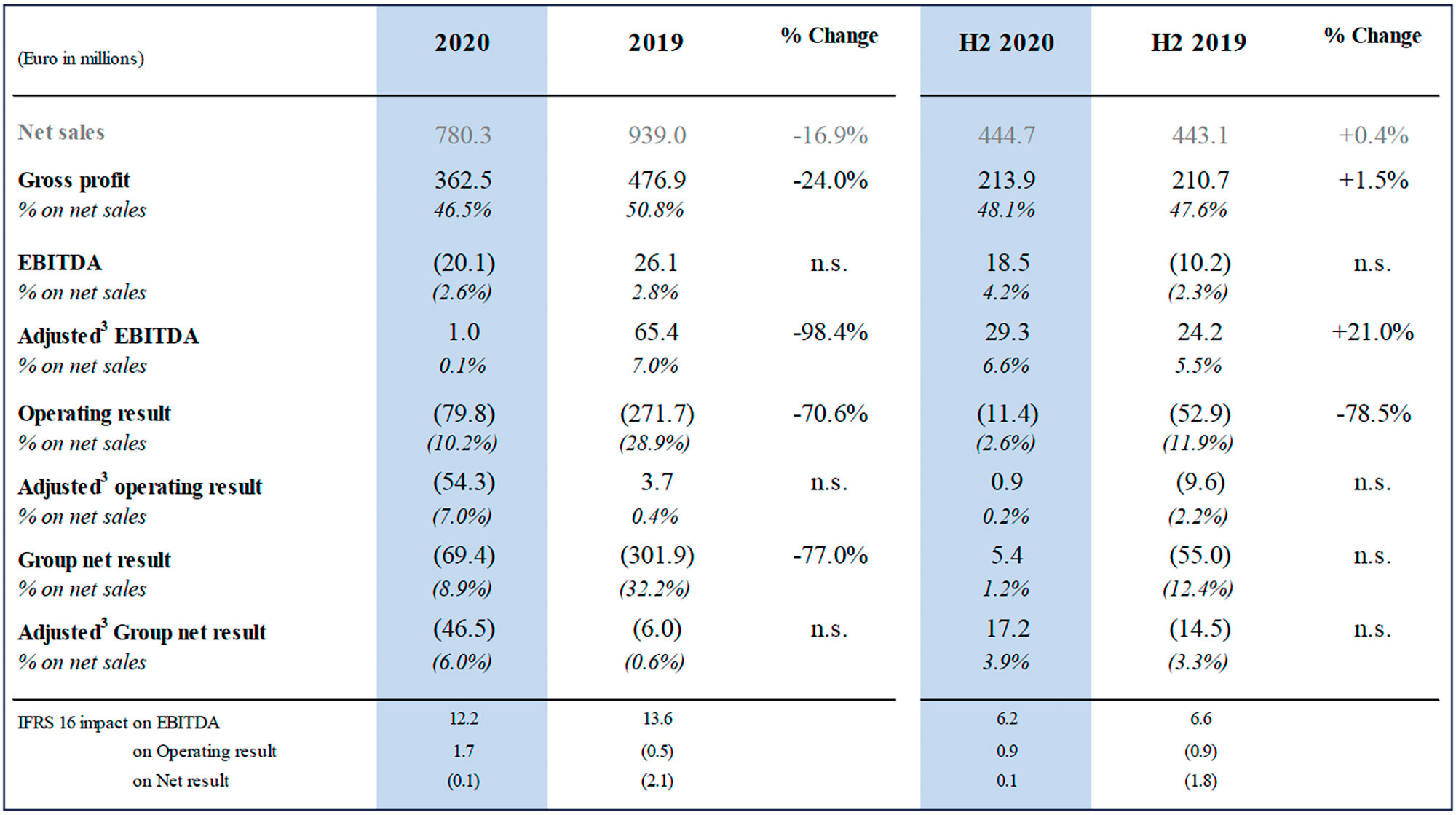

Key economic highlights of the Group economic performance in Full Year and H2 2020

2020 gross profit at Euro 362.5 million, down 24.0% compared to Euro 476.9 million in 2019, with the gross margin on sales declining to 46.5% from 50.8% in the previous year.

The industrial performance reflected on one side the significant drop of production volumes incurred in H1 2020, on the other a negative sales mix effect and non-recurring costs for obsolescence and write-offs of fixed assets at the end of year. Gross profit increased by 1.5% in the second half of 2020 compared to the same period of 2019, with the gross margin improving to 48.1% of sales from 44.3% recorded in the first half of the year and 47.6% registered in the same period of 2019;

2020 adjusted EBITDA at Euro 1.0 million, down 98.4% compared to Euro 65.4 million in 2019. In the second half of 2020, the Group’s adjusted EBITDA increased to Euro 29.3 million, up 21.0% compared to Euro 24.2 million in the second half of 2019, fully recovering the loss of Euro 28.3 million recorded in the first half of 2020. In the full year, selling, general and administrative expenses, excluding D&A, decreased by 13.3% compared to the prior year as the Group strived to contain the negative impact of the operating deleverage by accelerating the execution actions behind its overheads cost saving program, and utilizing the available contingency measures. In the second half of 2020, SG&A expenses benefitted from lower royalty and marketing contribution costs, while logistics costs to move products whether by sea, air or land climbed 39.8% (+13.7% in 2020).

2020 adjusted operating result at a loss of Euro 54.3 million compared to the profit of Euro 3.7 million recorded in 2019. In 2020, D&A, excluding non-recurring write-offs of fixed assets, declined by 10.4% compared to the prior year mainly due the effect of the manufacturing downsizing initiated in 2019 in line with the Group’s restructuring plan and the lower organic investments incurred in the year. In the second half of 2020, the adjusted operating result finished slightly positive, at Euro 0.9 million compared to the adjusted operating loss of Euro 9.6 million recorded in H2 2019.

2020 adjusted net result at a loss of Euro 46.5 million compared to the loss of Euro 6.0 million recorded in 2019. Below the operating result, the main drivers were:

- net financial charges increasing to Euro 24.1 million compared to Euro 7.3 million in 2019, mainly due to negative exchange rates differences and a higher average gross debt;

- a positive accounting adjustment equal to Euro 19.8 million as a result of the reduced liability for put&call options on non-controlling interests due to the revision of the financial plans reflecting the impacts of the Covid-19 pandemic;

- a total tax benefit of Euro 14.4 million compared to the income taxes of Euro 22.9 million booked in 2019, mainly as a result of the US CARES Act which provided for the opportunity to carryback net tax losses, with a positive rate differential impact.

In the second half of 2020, the Group’s adjusted net result equalled a profit of Euro 17.2 million compared to an adjusted net loss of Euro 14.5 million in H2 2019.

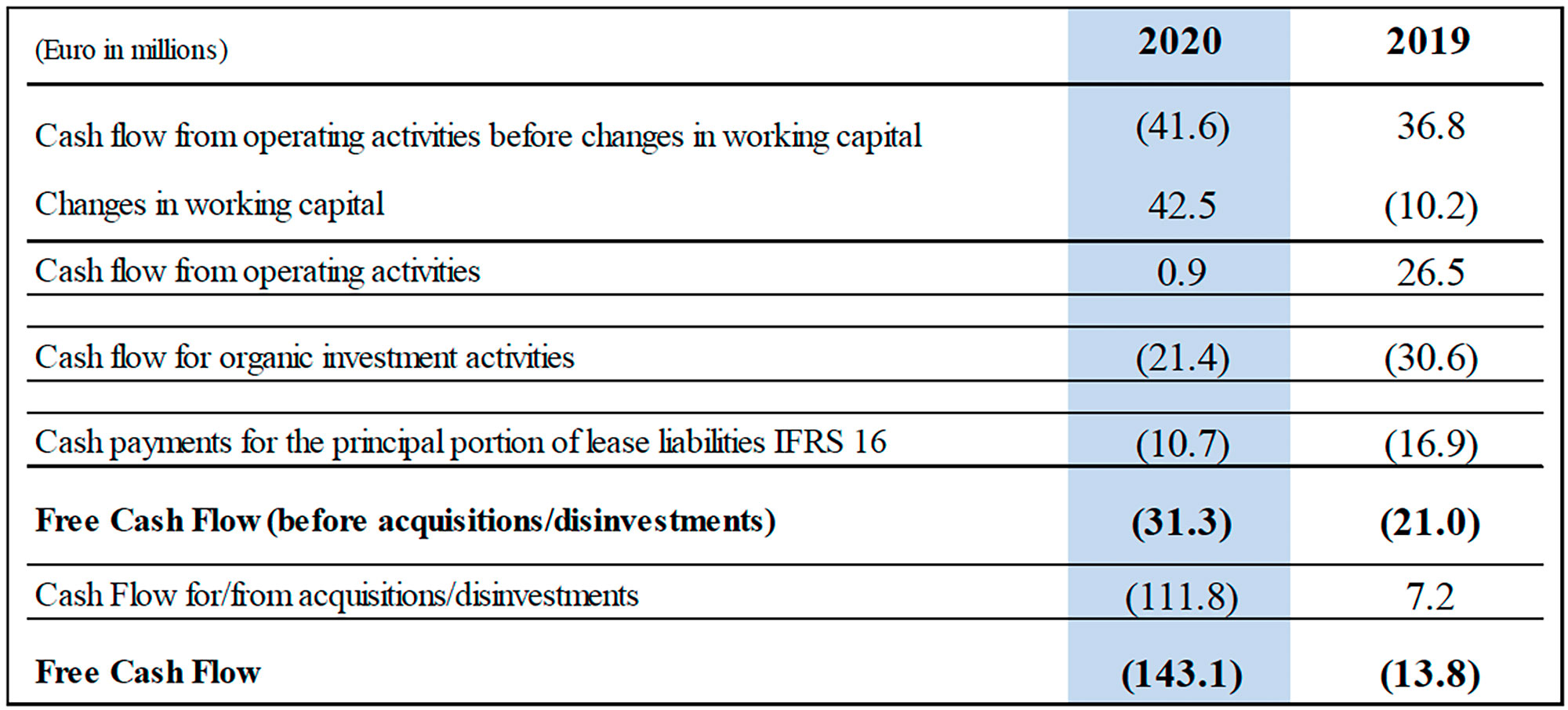

Key cash flow data and financial performance

In 2020, Safilo’s Free Cash Flow before the acquisitions/disinvestments equalled a cash absorption of Euro 31.3 million compared to the negative Free Cash Flow of Euro 21.0 million recorded in 2019.

Safilo closed the year with a slightly positive cash flow from operating activities of Euro 0.9 million, which reflected the Group’s strict control on working capital management, resulting in a cash generation of Euro 42.5 million, sufficient to fully offset the negative economic result of the year. In particular, the key driver of the positive net working capital dynamic was the significant reduction of inventories, which prudentially continued into the second half of the year after the tight control placed by the Group on stock levels in the first, most difficult semester.

Trade receivables, which increased in the third and fourth quarters as a result of the improved sales performance, remained a decreasing item on a full year basis as they also benefitted of a much stronger cash collection activity resumed by the Group in the second half. On the other hand, in the fourth quarter the Group made further progress in the normalization of trade payables.

In 2020, cash flow for organic investments amounted to Euro 21.4 million compared to a capital expenditure of Euro 30.6 million in 2019.

At December 31, 2020, the Group’s net debt stood at Euro 222.1 million (Euro 179.0 million pre-IFRS 16), compared to Euro 74.8 million in 2019 and Euro 201.7 million at the end of September 2020 (respectively Euro 27.8 million and Euro 155.8 million pre-IFRS 16). Excluding the net investment of Euro 111.8 million for the acquisition of Privé Revaux and

Blenders Eyewear, the higher net debt position at the end of 2020 reflected the economic performance deterioration suffered in a year heavily impacted by the Covid-19 pandemic.

The key components of the Group’s net debt at the end of December 2020 were the following:

- a long-term debt position of Euro 278.4 million, made of the bank loans for Euro 151.5 million (including the Euro 108 million Term Loan facility guaranteed by SACE), the shareholder loan for Euro 93.5 million and an IFRS-16 effect for Euro 33.5 million;

- a short-term debt position of Euro 32.6 million, made of the bank loans and other short-term borrowings for Euro 23 million and an IFRS-16 effect for Euro 9.6 million;

- a cash position of Euro 89.0 million.

Business update in relation to the covid-19 pandemic

Business environment at the beginning of 2021 remained affected by the containment actions still in place in many countries to halt the spread of Covid-19 and the uncertainties over the scale and timing of the expected rebound in consumer demand across the different geographies. Safilo’s business activity in January and February were in line with management’s expectations for a moderate start to the year compared to the very positive sales trends recorded at the beginning of 2020, while the first days of March support the expectation for a significant business rebound compared to the same month last year. Based on the current visibility on the order book, the Group expects its total net sales for the first quarter of 2021 to grow, at constant exchange rates, in a high-single to low-double digit range compared to Q1 2020.

Other resolutions by the board of directors:

- Approval of the Consolidated Non-Financial Information (Sustainability Report)

Together with the 2020 Annual Report, the Board of Directors of Safilo Group S.p.A. approved the 2020 Consolidated Non-Financial Information (Sustainability Report), in line with the application of the non-financial reporting obligation under Legislative Decree 254/2016.

- Appointment of the Board of Directors for the three-year period 2021-2023

The Board of Directors of Safilo Group S.p.A. also resolved to submit to the Shareholders’ Meeting of the Company called on 29 April, inter alia, the appointment of the administrative body for the three-year period 2021-2023. The related notice and related explanatory reports will be duly published in accordance with the terms provided for by law.