“We first would like to express our heartfelt solidarity with our colleagues in Israel and their families, as well as with all those suffering from the devastating situation.”

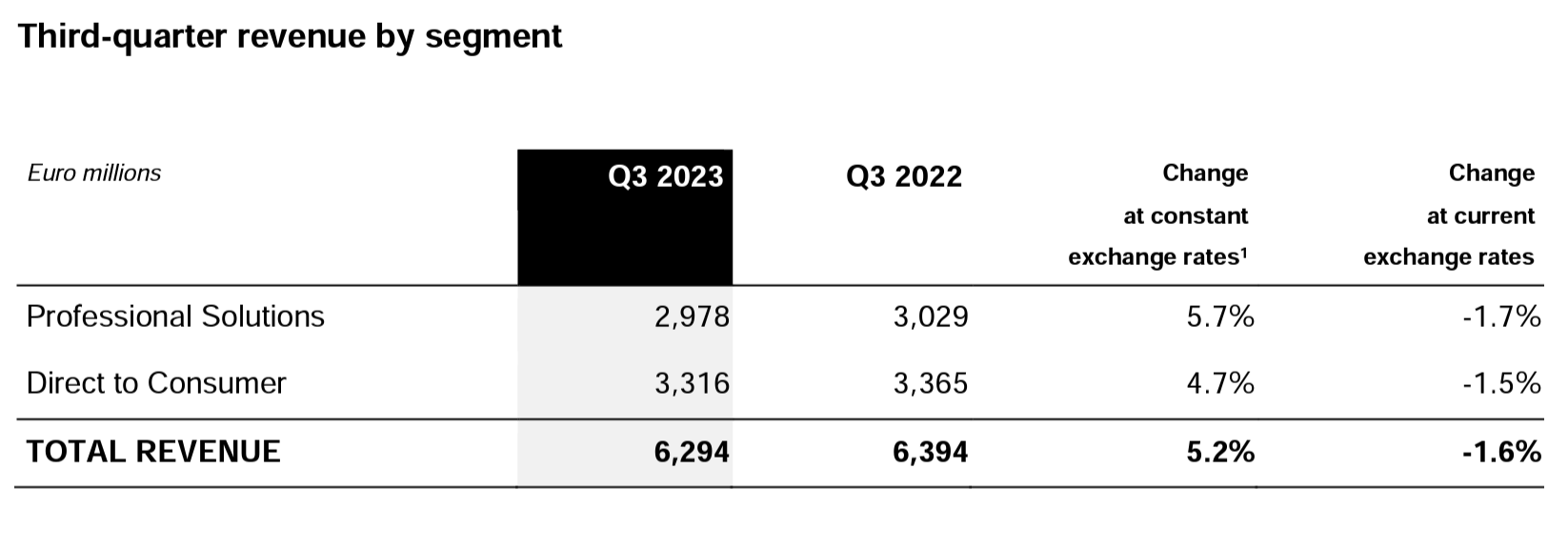

(PRESS RELEASE) CHARENTON-LE-PONT, FR — EssilorLuxottica announced today that consolidated revenue for the third quarter of 2023 totaled Euro 6,294 million, representing a year-onyear increase of 5.2% at constant exchange rates1 compared to the third quarter of 2022 (-1.6% at current exchange rates).

Our Company, like our people, is incredibly resilient. This past quarter, every business and geography in our Group contributed to the sound growth, with recent launches like the Varilux XR series and Swarovski gaining traction. The bold and transformational approach we promised to take at EssilorLuxottica is being realized today through initiatives like Ray-Ban Meta, Nuance Audio and Helix – these moves will light the way for the industry for many years to come. We are doubling down on our strengths, including our operations footprint, with a new plant in Rayong, Thailand, that truly showcases the EssilorLuxottica vision with frames and lenses under the same roof. This is a significant step in our commitment to better address the growing global visual care needs while expanding and balancing our geographical footprint.

Our Company, like our people, is incredibly resilient. This past quarter, every business and geography in our Group contributed to the sound growth, with recent launches like the Varilux XR series and Swarovski gaining traction. The bold and transformational approach we promised to take at EssilorLuxottica is being realized today through initiatives like Ray-Ban Meta, Nuance Audio and Helix – these moves will light the way for the industry for many years to come. We are doubling down on our strengths, including our operations footprint, with a new plant in Rayong, Thailand, that truly showcases the EssilorLuxottica vision with frames and lenses under the same roof. This is a significant step in our commitment to better address the growing global visual care needs while expanding and balancing our geographical footprint.

Highlights

Revenue in the first nine months of 2023 was up 7.2% compared to 2022 with the year-to-date trend continuing to exceed the mid-single-digit long-term target. The third quarter was in slight deceleration compared to the first-half due to a weaker sun retail business now also affecting the EMEA region on top of North America, and a tougher comparison base in Asia-Pacific. The prescription business confirmed its resilience relying on a strong price-mix sustained by the successful launch of the Varilux XR series globally and the continued, excellent performance of Stellest. Both segments contributed equally well to the overall results.

Advertisement

Professional Solutions

In the third quarter, the wholesale segment recorded revenue of Euro 2,978 million, up 5.7% compared to the same quarter of 2022 (-1.7% at current exchange rates).

All the regions were positive in the period. North America kept growing in line with the second quarter, up almost 3% supported by frames and value-added lenses with a sound performance of the newly introduced Varilux XR. EMEA confirmed the robust growth pace, up 7% thanks to both mature and emerging markets, with frames nicely progressing and lenses supported by Varilux XR. Asia-Pacific was up double digits, sustained by a strong Greater China boosted by Stellest. Latin America was up midsingle digit supported by a robust Mexico.

Direct to Consumer

In the third quarter, the retail segment registered revenue of Euro 3,316 million, up 4.7% compared to the same period of 2022 (-1.5% at current exchange rates).

All the regions were on the rise in the quarter. North America grew with the optical banners and the managed vision care business, while the sun business confirmed the negative trend of the previous quarters. In EMEA, the optical networks continued to grow strongly reaping the benefits of the integration in progress, while the sun category decelerated affected by adverse weather conditions. Asia-Pacific rose double digits, with the Australian optical business nicely growing against a challenging comparison base. Latin America expanded high-single digit, driven by the optical banners. Overall comparable-store sales2 were up 4%, while e-commerce was slightly negative mainly dragged by the sun business in North America.

Advertisement

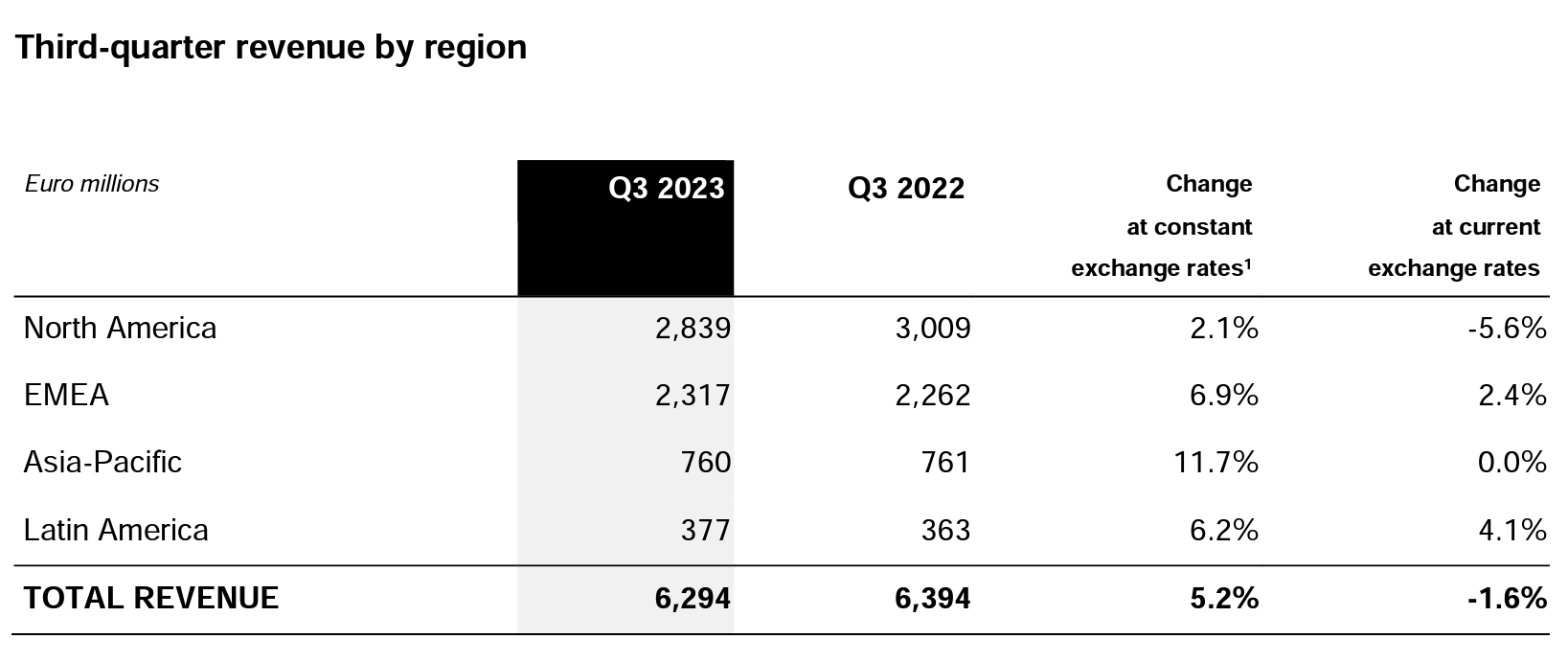

North America

North America posted revenue of Euro 2,839 million, up 2.1% compared to the third quarter of 2022 (-5.6% at current exchange rates), in line with the performance of the previous quarter.

Professional Solutions was up low-single digit. The lens business achieved positive results fueled by the premium brand portfolio, in particular Varilux. The introduction of the XR series in July already delivered a visible impact on the quarterly performance, predominantly in the independent channel, as its penetration ramped up swiftly helping the overall favorable price-mix. Trends in the frame business were bolstered by the continued momentum in the luxury license portfolio. Contact lenses grew strongly, in line with the trend of the first half of the year.

Direct to Consumer was up low-single digit. The segment was strongly supported by the vision care offering, including the optical brick-and-mortar banners and the managed vision care divison, while the sun business continued to be a drag. Comparable-store sales2 at LensCrafters, Target Optical and Pearle Vision were all positive driven by the excellent performance of customers backed by vision insurance and a positive price-mix. Comparable-store sales2 at Sunglass Hut remained negative throughout the quarter.

EMEA

EMEA posted revenue of Euro 2,317 million, up 6.9% compared to the third quarter of 2022 (+2.4% at current exchange rates), with both segments equally strong.

Advertisement

Professional Solutions was up mid-to-high-single digit. All countries registered a positive performance with the only exception of Scandinavia. The growth in the emerging markets of EMEA outpaced the nonetheless solid results of the mature markets with the key countries of France, Italy, the UK and Germany all contributing. The lens business continued to advance positively with the progressive portfolio in good shape boosted by the new Varilux XR series. Frames were still the best performing category thanks to a robust contribution of sunglasses and prescription frames starting to advance on a more dynamic pace. The first Swarovski collection was received with great enthusiasm by the market starting from September.

Direct to Consumer was up mid-to-high-single digit. Comparable-store sales2 in optical were up 9% 4/9 underpinned by the continued, strong performance in the key banners of Vision Express (UK), Générale d’Optique (France), Salmoiraghi & Viganò (Italy) and Synoptik (Scandinavia). The integration process of the former GrandVision stores is well on track with an increasing share of EssilorLuxottica’s own products on the shelves as well as the upgrade of the assortment into a higher value offering. Comparable-store sales2 at Sunglass Hut were up low-single digit in the quarter with July and August strained by adverse weather but bouncing back in September as the meteorological conditions improved.

Asia-Pacific

Asia-Pacific posted revenue of Euro 760 million, up 11.7% compared to the third quarter of 2022 (flat at current exchange rates), on top of the strongest quarter of last year.

Professional Solutions was up double digits. China was the best performing country effectively leveraging its myopia control portfolio in the back-to-school season. Stellest doubled its revenues once again. On top of that, the frame portfolio delivered an excellent quarter driven by Ray-Ban, Oakley and luxury as well as Bolon in China. India, Japan and South Korea all grew double digits.

Direct to Consumer was up double digits. Comparable-store sales2 in OPSM grew on a tough comparison base sustained by a favorable price-mix and a successful in-store execution. The retail performance in China continued to be highly favorable with comparable-store sales2 advancing at double digits in both LensCrafters and Sunglass Hut. The latter continued to expand strongly also in Southeast Asia.

Latin America

Latin America posted revenue of Euro 377 million, up 6.2% compared to the third quarter of 2022 (+4.1% at current exchange rates), in slight deceleration compared to the previous quarter.

Professional Solutions was up mid-single digit driven by a robust Mexico. The performance in the region was supported by both categories. The frame business was bolstered by a buoyant Ray-Ban in Brazil, while the lens business was boosted by Varilux growing double digits.

Direct to Consumer was up high-single digit. The growth of the region was driven by optical with comparable-store sales2 up accordingly driven by the progressing integration of the former GrandVision banners in Mexico and GMO confirming its sound growth trajectory. Sunglass Hut comparable-store sales2 continued to be solid in the region.

In the first nine months of 2023, revenue amounted to Euro 19,145 million, up 7.2% versus the same period of 2022 (+4.1% at current exchange rates), with both Professional Solutions and Direct to Consumer pacing on an equal rate.

Professional Solutions was up 7.2% versus the first nine months of 2022 (+3.9% at current exchange rates), with all regions positive. Asia-Pacific was the fastest growing region, while the others progressed on a broadly similar, solid pace. Direct to Consumer grew 7.2% (+4.3% at current exchange rates), delivering double-digit growth across all the regions except North America dragged by a weak Sunglass Hut. The overall growth of the segment was driven by the optical category.

All regions grew in the first nine months of the year. Asia-Pacific, up 15.7% (+7.9% at current exchange rates), strongly contributed thanks to the reopening of China. The solid growth in EMEA, +8.8% (+5.6% at current exchange rates) and Latin America, +8.8% (+9.0% at current exchange rates), both came on top of a double-digit performance last year. North America was up 3.6% (+1.5% at current exchange rates), helped by the resilience of its optical business.

Long-Term Outlook

The Company confirms its target of mid-single-digit annual revenue growth from 2022 to 2026 at constant exchange rates1 (based on 2021 pro forma3 revenue) and expects to achieve an adjusted4 operating profit as a percentage of revenue in the range of 19-20% by the end of that period.

Conference Call

A conference call in English will be held today at 6:30 pm CEST. The meeting will be available live and may also be heard later here.

Notes

As table totals are based on unrounded figures, there may be discrepancies between these totals and the sum of their rounded component.

1 Constant exchange rates: figures at constant exchange rates have been calculated using the average exchange rates in effect for the corresponding period in the relevant comparative year.

2 Comparable-store sales: reflect, for comparison purposes, the change in sales from one period to another by taking into account in the more recent period only those stores already open during the comparable prior period. For each geographic area, the calculation applies the average exchange rate of the prior period to both periods.

3 Comparable or pro forma (revenue): comparable revenue includes, for 2021, the contribution of GrandVision’s revenue to EssilorLuxottica as if the combination between EssilorLuxottica and GrandVision (the “GV Acquisition”), as well as the disposals of businesses required by antitrust authorities in the context of the GV Acquisition, had occurred on January 1, 2021. Comparable revenue has been prepared for illustrative purpose only with the aim to provide meaningful comparable information.

4 Adjusted measures or figures: adjusted from the expenses or income related to the combination of Essilor and Luxottica (the “EL Combination”), the acquisition of GrandVision (the “GV Acquisition”), other strategic and material acquisitions, and other transactions that are unusual, infrequent or unrelated to the normal course of business as the impact of these events might affect the understanding of the Group’s performance. A description of those other transactions that are unusual, infrequent or unrelated to the normal course of business is provided in the half-year and year-end disclosure (in the dedicated paragraph Adjusted measures).

DISCLAIMER

This press release contains forward-looking statements that reflect EssilorLuxottica’s current views with respect to future events and financial and operational performance. These forward-looking statements are based on EssilorLuxottica’s beliefs, assumptions and expectations regarding future events and trends that affect EssilorLuxottica’s future performance, taking into account all information currently available to EssilorLuxottica, and are not guarantees of future performance. By their nature, forwardlooking statements involve risks and uncertainties because they relate to events and depend on circumstances that may or may not occur in the future, and EssilorLuxottica cannot guarantee the accuracy and completeness of forward-looking statements. A number of important factors, not all of which are known to EssilorLuxottica or are within EssilorLuxottica’s control, could cause actual results or outcomes to differ materially from those expressed in any forward-looking statement as a result of risks and uncertainties facing EssilorLuxottica. Any forward- looking statements are made only as of the date of this press release, and EssilorLuxottica assumes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information or for any other reason.