(PRESS RELEASE) CHARENTON-LE-PONT, FRANCE — EssilorLuxottica announced that consolidated revenue for the third quarter of 2022 totaled Euro 6,394 million, representing a year-on-year increase of 8.2%2 at constant exchange rates compared to the third quarter of 2021 (+17.0% at current exchange rates).

Francesco Milleri, chairman and CEO, and Paul du Saillant, deputy CEO at EssilorLuxottica commented: “We are pleased with the solid performance our Company delivered in the third quarter of this year, with all the regions posting growth, from Asia-Pacific and Latin America, to EMEA and North America. The results once again demonstrate the power of our business model as well as the determination and agility of our almost 200,000 people worldwide, committed to the long term view we shared at our Capital Market Day this year.

Proving the impact we can have together, we earned the sixth spot on the Fortune Change the World list and celebrated World Sight Day by delivering vision care to more than 350,000 children and adults worldwide, all in the same week. We are a company that consistently delivers results and supports our communities, this ties into our commitment to growing the market for the benefit of all stakeholders.

Looking ahead, we remain confident in our strategic vision and our ability to deliver on our long-term outlook.”

Unless otherwise specified, the commentary in the following pages is based on revenue performance at constant exchange rates versus 2021 comparable revenue.

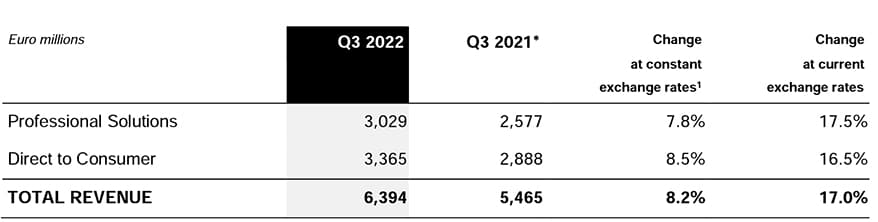

Revenue by operating segment

Comparable revenue

Advertisement

Professional Solutions

In the third quarter of the year, the wholesale business registered revenue of Euro 3,029 million, up 7.8% compared to the same period of 2021 (+17.5% at current exchange rates).

The business expanded at a slightly faster pace compared to the second quarter with rebounding AsiaPacific and Latin America growing double digits, as well as EMEA and North America progressing at a high- and low-single-digit rate, respectively.

EMEA gained momentum on the back of an acceleration in France, Turkey and the Middle East, paired with the sound growth of Italy, the UK and Spain, driven in particular by the sun frame category. AsiaPacific was boosted by Mainland China turning mid-teens positive and the strong growth of all the other countries in the region. North America progressed at low-single digit, slightly slower than in the second quarter, held back by negative independent ECPs and a softer frame business, partly offset by stronger lenses. In Latin America, Brazil and Mexico kept a solid growth trajectory.

Direct to Consumer

Advertisement

In the third quarter, the retail business recorded revenue of Euro 3,365 million, up 8.5% compared to the same period of 2021 (+16.5% at current exchange rates).

With Asia-Pacific strongly bouncing back, from slightly negative in the second quarter to double-digit growth in the third, all the regions contributed to the segment performance – like in Professional Solutions. Comparable-store sales3 progressed at 6.5%, broadly in line with the previous quarter, confirming the positive performance for both optical and sun banners globally. E-commerce posted midsingle-digit growth, on top of an almost 50% jump in the third quarter of 2021 versus 2019, with EyeBuyDirect.com standing out as the top-performing platform in the quarter, growing in the mid-teens range.

In brick-and-mortar retail, revenue grew mid-single digit in North America, with LensCrafters and Sunglass Hut respectively low-single digit negative and positive, and Target Optical low-single digit positive. EMEA landed still in the double-digit territory, progressively normalizing after the remarkable rebound of the first and second quarter, with sun still fueled by tourism in the high season of the third quarter and optical confirming its solid trajectory. Asia-Pacific strongly recovered, from single digit in the second quarter up to around one third in the third quarter, driven by both optical and sun, benefiting from the easy comparison in Australia, which was affected by restrictions in the same period of 2021. The reopenings in China, following severe lockdowns in the first half of this year, also supported the recovery. Latin America was in deceleration, from double digits in the second quarter to high-single digit in the third. Optical slowed down, particularly in Chile and Peru (on a tough comparison base), which offset the mid-teen growth of GrandVision’s banners, mostly driven by Mexico.

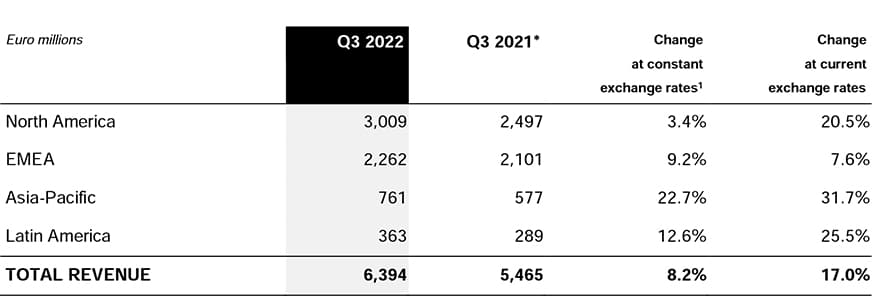

Revenue by geographical area

Comparable revenue

North America

Advertisement

North America posted revenue of Euro 3,009 million, up 3.4% compared to the third quarter of 2021 (+20.5% at current exchange rates), a slight acceleration versus the second quarter driven by the Direct to Consumer division.

Professional Solutions was up low-single digit. The lens business improved compared to the previous quarter with branded lenses continuing to outpace the unbranded product portfolio. The frame business delivered softer results versus a comparison base which was the toughest of last year. Key accounts, department stores and third-party e-commerce had a lead over the independent channel, which was suffering mostly on the non-program customers. EssilorLuxottica 360 as well as the alliances, in particular Vision Source, kept up their healthy performance.

Direct to Consumer grew mid-single digit. Revenue of LensCrafters was down low-single digit on a challenging comparison base, but price-mix held up well on both lenses and frames thanks to the increased penetration of Varilux, Transitions and Blue IQ as well as the luxury eyewear portfolio. Sunglass Hut was low-single-digit positive despite the increasingly challenging comparison base of last year. Results were favored by continued strong traffic and touristic locations especially during the August holiday period. For the third consecutive quarter, Oakley was the best performing banner in comparablestore sales3, reaping the benefits of the successful brand building campaigns launched in recent years as well as the store format evolution. The e-commerce business returned to growth mode advancing mid-single digit on top of the two thirds expansion in the third quarter of 2021 versus 2019. EyeBuyDirect.com and SunglassHut.com were once again leading the way with Oakley.com closely following suit. EyeMed continued its double-digit growth trajectory.

EMEA

EMEA recorded revenue of Euro 2,262 million, up 9.2% compared to the third quarter of 2021 (7.6% at current exchange rates), benefitting from the contribution of both wholesale and retail segments.

Professional Solutions continued its positive trajectory, posting high-single-digit growth. The performance was driven by the sun business, with strong luxury brands (Prada almost doubling), and the continued solid performance of the lens business. The division benefitted from the acceleration in the key country of France, along with Turkey and the Middle East, as well as sound growth in Italy, Spain and the UK.

Brick-and-mortar revenue closed up double digits, with the sun business continuing to be the leading growth driver, benefitting also from touristic flows. Sunglass Hut, progressively normalizing after the outstanding growth of the two previous quarters, advanced in revenue by 60% driven by luxury brands. The optical business continued its growth trajectory, with Salmoiraghi & Viganò posting double-digit revenue growth in Italy and an overall solid performance in the GrandVision network despite a record comparison base last year, led by the UK, France and Spain. The e-commerce business supported the performance of the region with a mid-single-digit growth and all main banners contributing.

Asia-Pacific

Asia-Pacific was the best performing region posting revenue of Euro 761 million, up 22.7% compared to the third quarter of 2021 (+31.7% at current exchange rates), with both segments sharply accelerating compared to the second quarter.

The Professional Solutions business expanded double digits in all main countries. After its negative performance in the previous quarter, Mainland China grew in the mid-teens as a consequence of fewer COVID-19 lockdowns impacting the country. The lens business performed particularly well effectively leveraging its myopia management portfolio during the back-to-school season. The growth of Stellest and CRT was boosted by the launch of new evolutions, namely Stellest x Crizal Rock and CRT5.0, while the distribution of Nikon D.O.T. and MiSight was off to a promising start. The other countries of the region continued their growth trajectory with South-East Asia and Australia visibly improving.

Brick-and-mortar revenue was up around one third in the quarter, with both optical and sun significantly accelerating compared to the second quarter. LensCrafters improved its performance in China with the repositioning of the banner starting to show positive signs and the new store format hosting the “Essilor Vision Center” launched in August. In Australia, all banners delivered strong growth compared to last year when the country was affected by COVID-19 related restrictions and store closures. OPSM’s revenue was up around one third, with branded lenses continuing to gain share. The strength of refurbished stores drove the performance at Sunglass Hut and Oakley in the country, more than doubling revenue as a whole. In addition, the luxury brands in Sunglass Hut continued to advance strongly. Sunglass Hut also confirmed the positive trajectory of the previous quarter in South-East Asia.

Latin America

Latin America posted revenue of Euro 363 million, up 12.6% compared to the third quarter of 2021 (+25.5% at current exchange rates) rebalancing its growth trajectory compared to the first half due to a toughening comparison base.

In Professional Solutions, Brazil grew mid-single digit. The lens business was sustained by the strong performance of Kodak and Varilux while the vivid demand for luxury eyewear brands continued to drive results on the frames side. Mexico accelerated in the third quarter with Argentina and Colombia keeping up the vibrant trend of the previous period.

The Direct to Consumer division progressed at high-single digit. The growth continued to be fueled by a strong performance of Sunglass Hut in Brazil and Mexico, both growing more than 40%, with the luxury frame portfolio continuing to play a vital role. In addition, the performance of Mexico continued to benefit from the opening of the “Palacio de Hierro” stores. Revenue in optical were low-single-digit positive as a result of a mixed performance between the banners. GMO crossed into negative territory compared to last year when revenue sharply accelerated, especially in the main market of Chile, while the GrandVision stores kept up the strong momentum of mid-teens revenue growth.

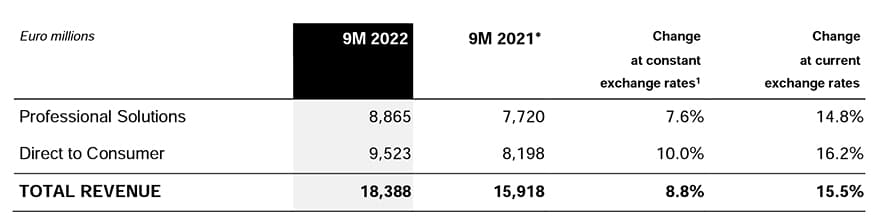

Nine-month revenue by operating segment

Comparable revenue

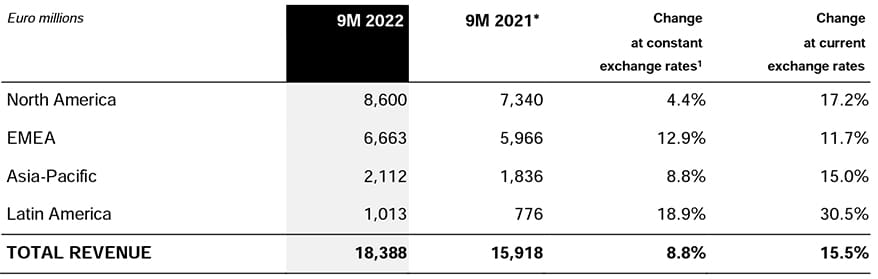

Nine-month revenue by geographical area

Comparable revenue

In the first nine months of 2022, revenue amounted to Euro 18,388 million, up 8.8% versus the same period of 2021 (+15.5% at current exchange rates). Year-on-year growth remained strong throughout the first three quarters of the year, despite the gradually toughening comparison base.

Professional Solutions was up 7.6% versus the first nine months of 2021 (+14.8% at current exchange rates). After a slight slowdown in the second quarter, the segment accelerated in the third quarter despite an even tougher comparison base. Direct to Consumer grew 10.0% (+16.2% at current exchange rates), driven by EMEA and Latin America, as well as Asia Pacific in the third quarter. Growth was driven by the sun category, while optical steadily progressed.

All regions grew in the first nine months of the year. Despite a tough comparison base in North America, the region posted solid results of +4.4% (+17.2% at current exchange rates). EMEA was up 12.9% (+11.7% at current exchange rates), leading the growth together with Latin America, the top performing region, up 18.9% (+30.5% at current exchange rates). Asia-Pacific grew 8.8% (+15.0% at current exchange rates), boosted by the strong acceleration of both divisions in the third quarter.

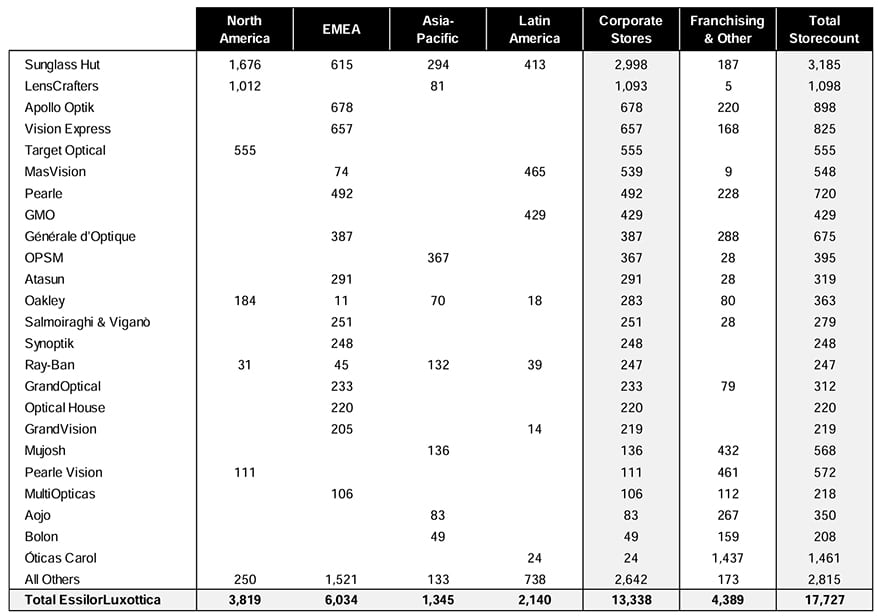

Storecount on September 30, 2022

Long-term Outlook confirmed at the Capital Market Day

During EssilorLuxottica’s Capital Market Day hosted in Milan on September 14, the CFO, Stefano Grassi, presented the financial roadmap of the Company, confirming the long-term outlook communicated on March 11 this year, summarized as follows:

mid-single-digit annual revenue growth from 2022 to 2026, at constant exchange rates1 (based on 2021 comparable2 revenue);

adjusted4 operating profit as a percentage of revenue in the range of 19-20% in 2026.

As a reminder, the full replay of the Capital Market Day presentations is available on its website. You may find it here.