BY THE NATURE of the beast, owning or managing any small business, especially one involving both medical billing and retail sales, requires some basic comprehension of finances, accounting, billing and/or taxes. Unfortunately, these are not skills generally taught in optometry schools or opticianry programs, so it becomes incumbent upon ECPs to find their own route to a financial education … or perish.

But you don’t know what you don’t know, so this financial self-education is often a trial-by-fire, learn-through-failure, minefield sort of endeavor. So we wanted to know if our readers considered themselves financially literate; and if yes, how they got there. For those who admitted they lacked in this area, we wanted to know what sort of challenges they faced and the questions they would ask a financial expert.

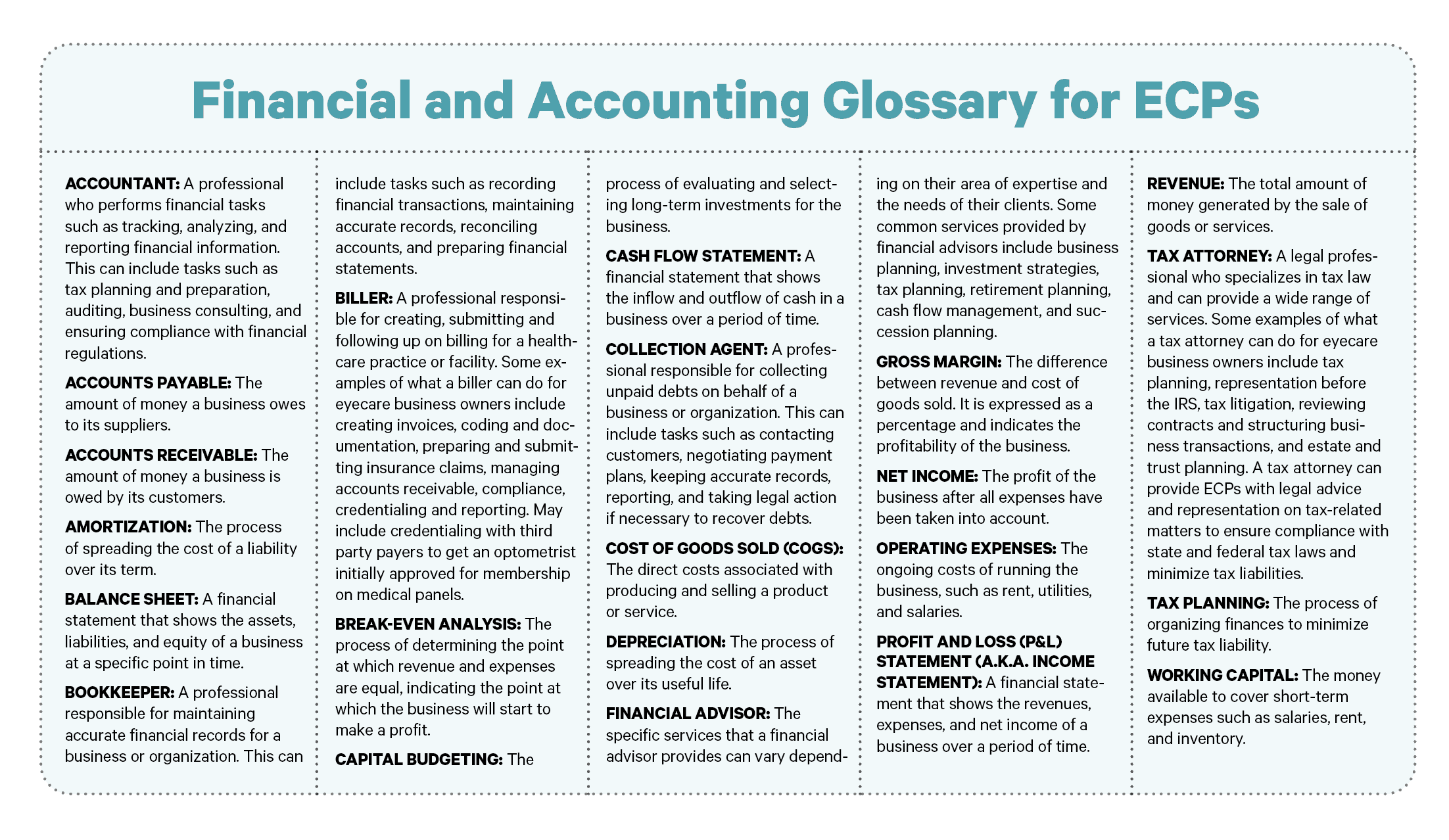

What we did was open Pandora’s Box. The questions were many, varied, and complicated — way too much to cover in one two-page story — and we needed an expert to help us tackle them. Luckily, we were able to tap Wade Weisz, OD, a former private practice optometrist turned bookkeeper, and Nathan Taylor, strategic advisor, of For Eyes Bookkeeping (foreyesbookkeeping.com), a professional bookkeeping firm specifically for the optometric community, to start our financial education. Consider what follows a financial primer with a specific topic tackled in each issue from here on out.

Advertisement

In eyecare, there are industry-specific financial concepts that make it particularly challenging. There are several factors that contribute to this and include: the ever-increasing cost of goods and services, the need for specialized training and equipment, and the fact that insurance reimbursement rates are often lower than the actual cost of care. These trends are likely to continue, even worsen, so the concepts of revenue and cost structure, particularly in relation to cost of goods and services, should be well understood in order to successfully manage a profitable eyecare practice.

Additionally, it is important for those in the eyecare industry to stay up-to-date on relevant regulations and changes so that they can remain compliant with evolving standards while also increasing profitability.

According to Weisz, the two most common mistakes he sees eyecare business owners make most often are: 1) Not collecting on accounts receivable; and 2) Carrying too much debt, especially credit card debt. Those are relatively self-explanatory, but a third common mistake is not having a clear understanding of their business’s financials. “Too often, the eyecare business owner is only interested in and reviews just the top-line revenue total on the P&L statement,” he says. “This can cause business owners to make poor decisions when it comes to revenue and expense management, debt servicing, pricing, spending, cash flow management and even hiring and occupancy costs. As a result, they may end up in over their heads and struggling to keep their businesses afloat.”

First up are priorities. Weisz’s advice for ECPs is to pay attention to these aspect of their business finances in order of importance:

- Top line revenue

- Accounts receivable and the aging thereof

- Payroll expenses

- COG

- Occupancy costs

- Net profit

- Cash flow … “You’d think that I would put cash flow at the top of the list because it is very important. But in a practical sense, cash flow is very hard to determine and is seldom used because there are two different methods of creating a Statement of Cash Flow and both are difficult to interpret and are often misleading,” he shares. “An alternative ‘quick and easy’ way to monitor cash flow is to run a Balance Sheet report that compares current results to results from the prior corresponding time period. The difference between the two totals is the net positive or negative cash flow.”

As we said, this is just the beginning. In the March issue, we will dig deeper into each of these priorities.

In subsequent months, we’ll explore more common mistakes, what to look for in a financial expert, what concepts ECPs must be at least superficially versed in when dealing with their financial experts, resources For Eyes recommends to help ECPs educate themselves, and readers’ specific financial questions.

Advertisement