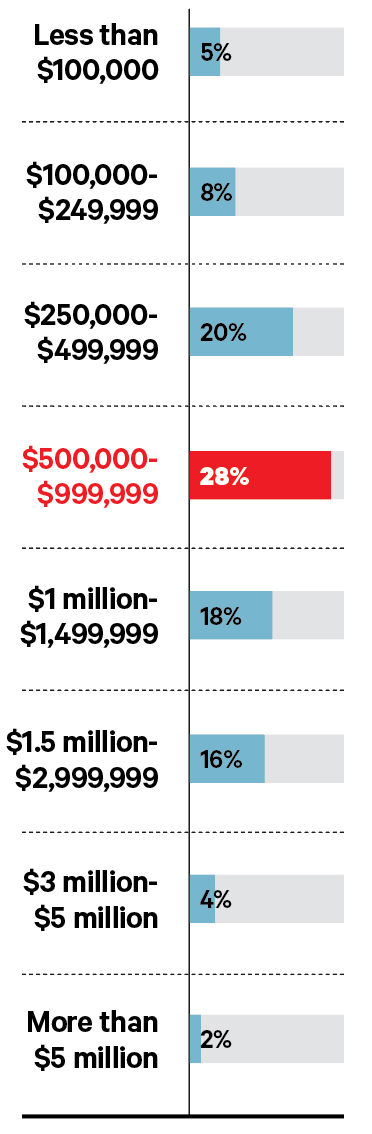

What were your total revenues in 2022?

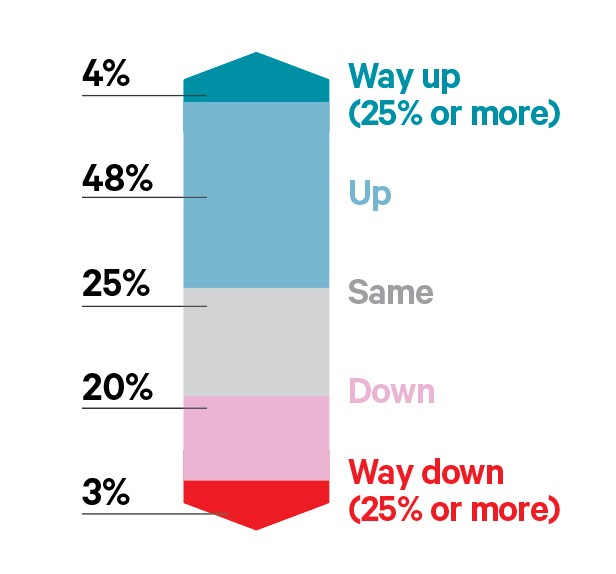

Based on the first eight months of this year, how do you expect your total revenues for 2023 to compare with 2022?

ECPs seem a little more optimistic this year. In last year’s survey, the largest proportion of respondents (44%) replied “Same” while only 35% replied “Up” or “Way up”.

What one thing are you doing now to drive sales that you weren’t doing five years ago?

- The overwhelming favorite here was increased social media presence in all its many forms, including asking for online reviews, video marketing, and collaborating with social media influencers. “Social media has been a great tool in increasing our business,” said one respondent. “[Promoting] local community events [has] kept our local customer base coming back time and time again.” In an adjacent strategy, many reported investigating ways to get the most out of their website, including online stores and virtual try on, search engine optimization, and “building a website to drive more business and linking to online advertising.”

- Marketing in general — and availing of outside help to get it right — was another constant theme. “Being really consistent with marketing. Running ads more frequently and sending more emails. Posting more interesting and edgier photos,” wrote one respondent. Many mentioned hiring marketing experts.

- Other frequently mentioned strategies were multiple pair sales, staff incentives, frame data/tracking stats, e-commerce management solutions like Optify, and focusing on higher-end frames.

Other replies of note:

- “Educating patients on the pitfalls of online ordering.”

- “Add-ons that work: Bruder masks, lid hygiene kits, anti-fatigue lenses and Rx sunglasses.”

- “Prescribing versus recommending, taking everyone through optical.”

- “Concierge service. We schedule appts for selection, pick up, repairs. Simplifies sales and our patients enjoy the individual attention.”

- “I am a big believer in incentive programs. I always expect a team member’s best, but if you routinely want above and beyond you better be willing to reward above and beyond, too.”

- “Explaining the benefits of different products for different things: computer glasses for specific work, etc.”

- “Developed a private label brand that still aligns with our handcrafted, luxury philosophy. Enables us to still capture those who might be on a budget and also ramp up second and third pairs by offering unique and enticing promotions that don’t affect our margins.”

Advertisement

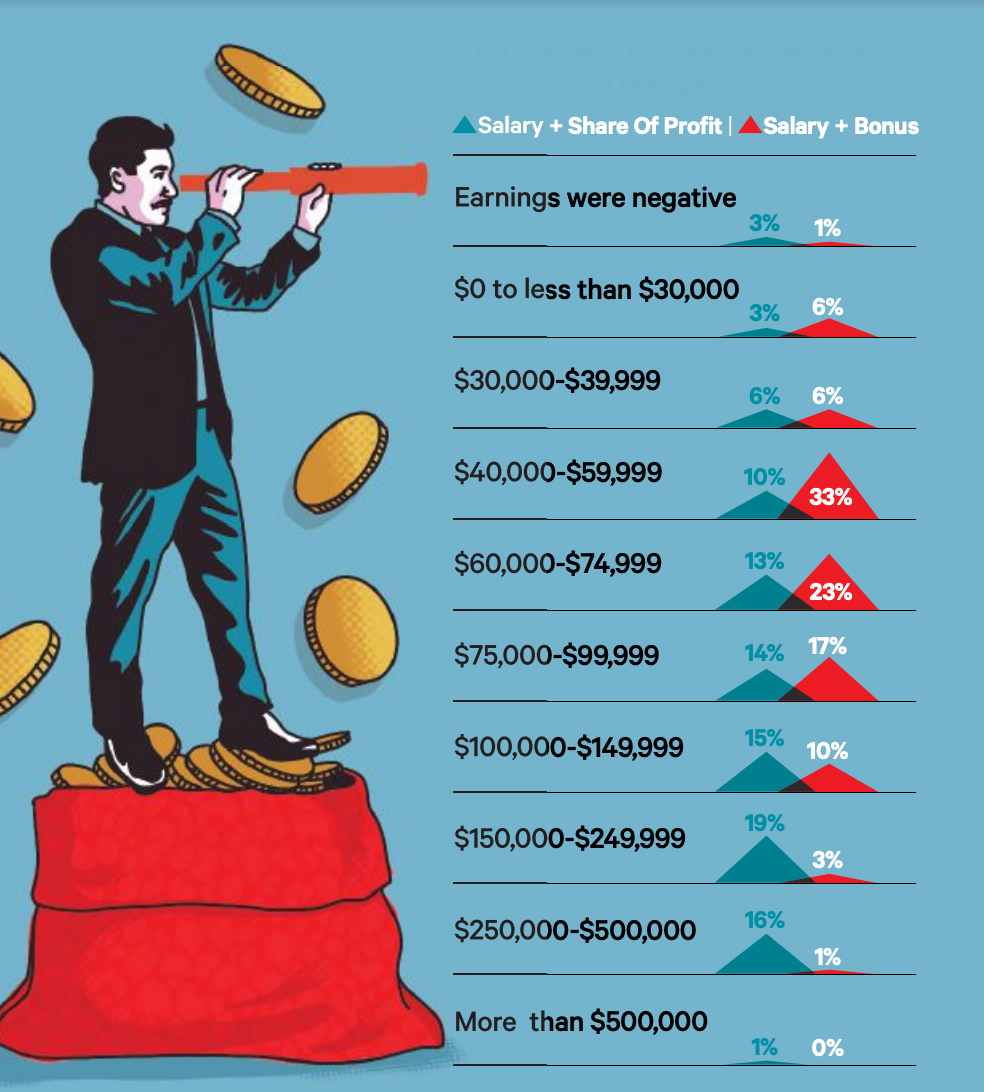

As a vision business owner, what did you earn last year?

Note: While we’d like to report the optical industry bucks the general trend of male business owners earning more than their female counterparts, sadly we cannot. Some 67% of male owners were in the top five earning categories, earning $75,000 or more, versus 53% of women. Males accounted for 79% of owners earning $250,000 or above. Higher-earning owners tended to be located in suburban outskirts or country towns (each accounting for 27% of owners taking home <$250K). Disappointingly, the gender disparity appears even greater among managers, a group that skews female. While nearly half (45%) of male managers reported earning $75,000 or above, just 21% of their female counterparts did so. And while only a handful of managers reported earning $150,000 or above, all were male.

What one thing were you doing to drive sales five years ago that you’ve stopped doing?

Continuing a trend we’ve noted for a number of years, conventional advertising — particularly newspaper ads and print marketing but also TV and radio spots — was the most frequently cited strategy dropped by eyecare businesses.

Another frequently jettisoned tactic is discounts, sales and giving stuff away, including offering discounts on glasses when CLs are ordered. “I’ve let my staff dictate some price increases in my practice that I was always trying to avoid, as well as learning not to waive fees that I may have been to quick to waive in the past,” said one respondent. No more “discounts just to discount!” said another.

More than one practice has given up on trunk shows — “We never had a lot of people show up for all the time and expense put in.”

Other replies of note:

- “Trade shows.”

- “Taking any insurance and patient that walked through the door.”

- “We used to be part of all downtown events. We realized that we are not all things to all people and only join those that support our target market.”

- “Five years ago, we were seeing patients every half hour. The pandemic changed my time with patients, and I’ve enjoyed practice again.”

- “Tolerating staff that got in the way of a cohesive office.”

- “Using ultra low-end frames as a majority of our stock.”

- “Individual commissions.”

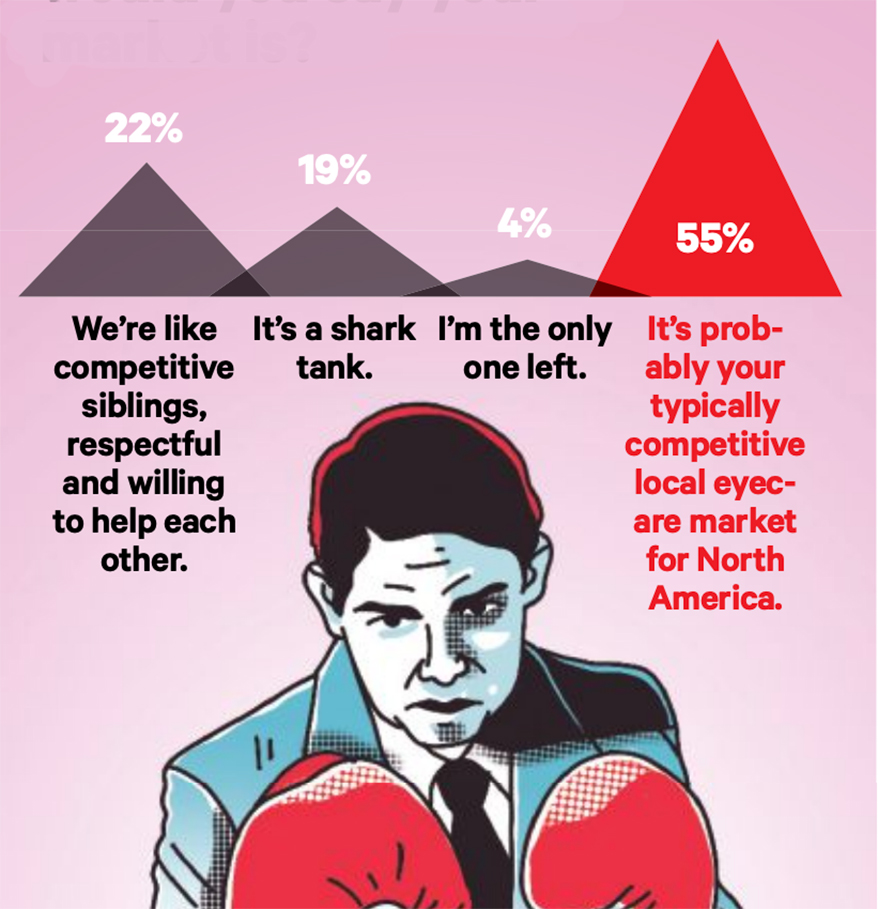

How competitive would you say your market is?

What do you think will be the next breakout category in eyecare or eyewear?

Not surprisingly, given the headlines of the past year or two, responses had an unmistakably ‘rise of the robots’ theme to them. The most commonly cited category was smart glasses and wearables, including Bluetooth-enabled or camera-equipped frames like Ray-Ban Meta, with many predicting consumers were now ready for some variant of the Google Glass that didn’t hit with the public a decade ago.

This was followed by AI-based products and technologies. At the moment there seems to be a general awareness that AI is “on the way,” even if few ECPs can articulate exactly how it will be used, as seen in the large number of respondents who simply replied “AI.” Some ventured more detailed replies, however, citing AI’s diagnostic potential and the possibilities of AI-inspired lens designs.

Sharing third place were two categories that have become perennials when we ask ECPs to cite breakout services: Online sales/telemedicine, and myopia management. “Online retail—selling what we are prescribing online… [and] online actual refractions,” predicted one.

“I truly have no idea but I’m sure it’ll be online somehow,” said another.

Other common responses were computer (or other device) glasses and indoor progressives, medication-dispensing or smart contacts, Neurolens glasses, sustainably produced frames and products, drill mount/custom rimless, MedSpa/aesthetic services, and 3D-printed frames.

Advertisement

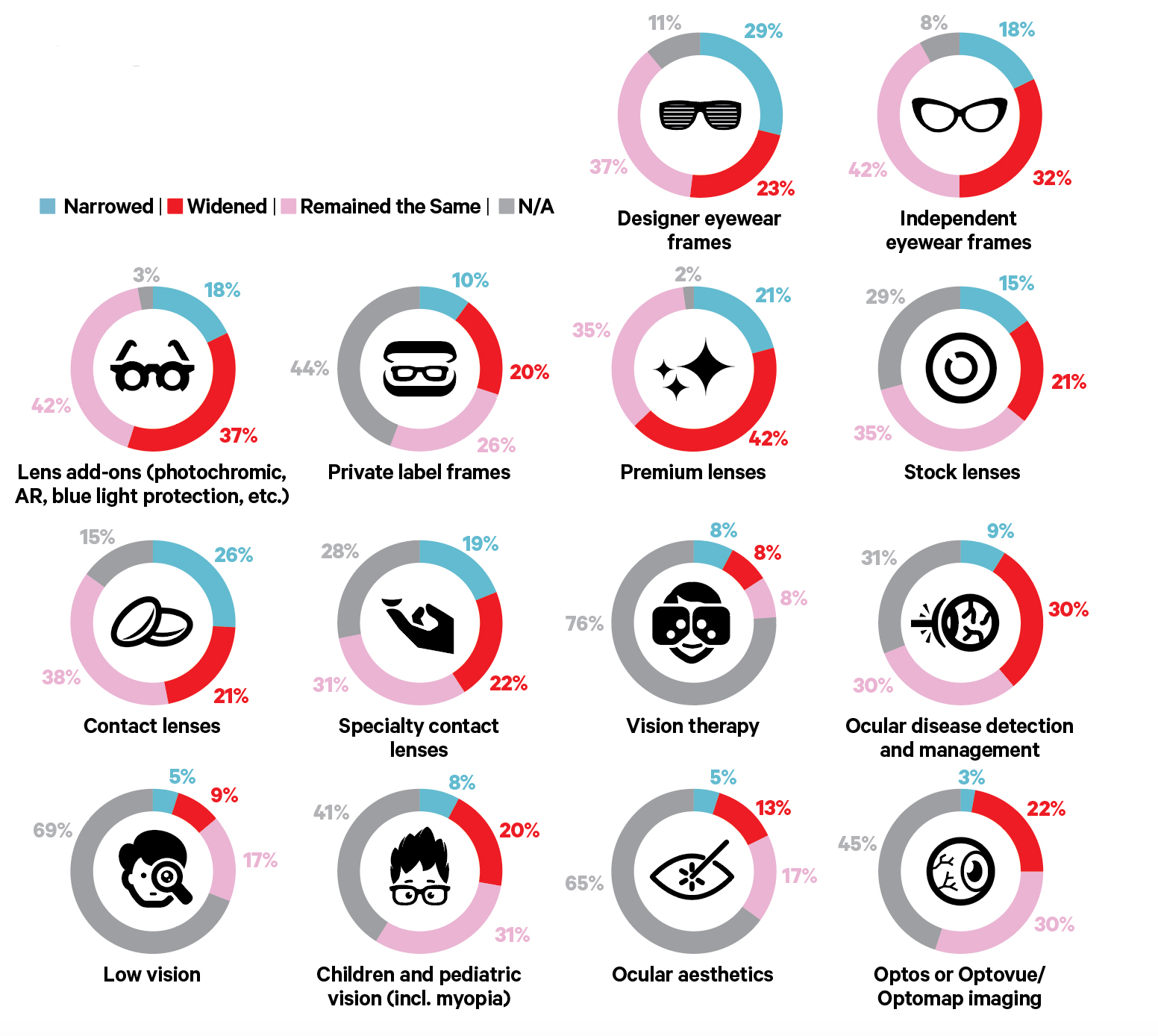

Have your margins widened or narrowed on the following categories compared with five years ago/pre-Covid times?

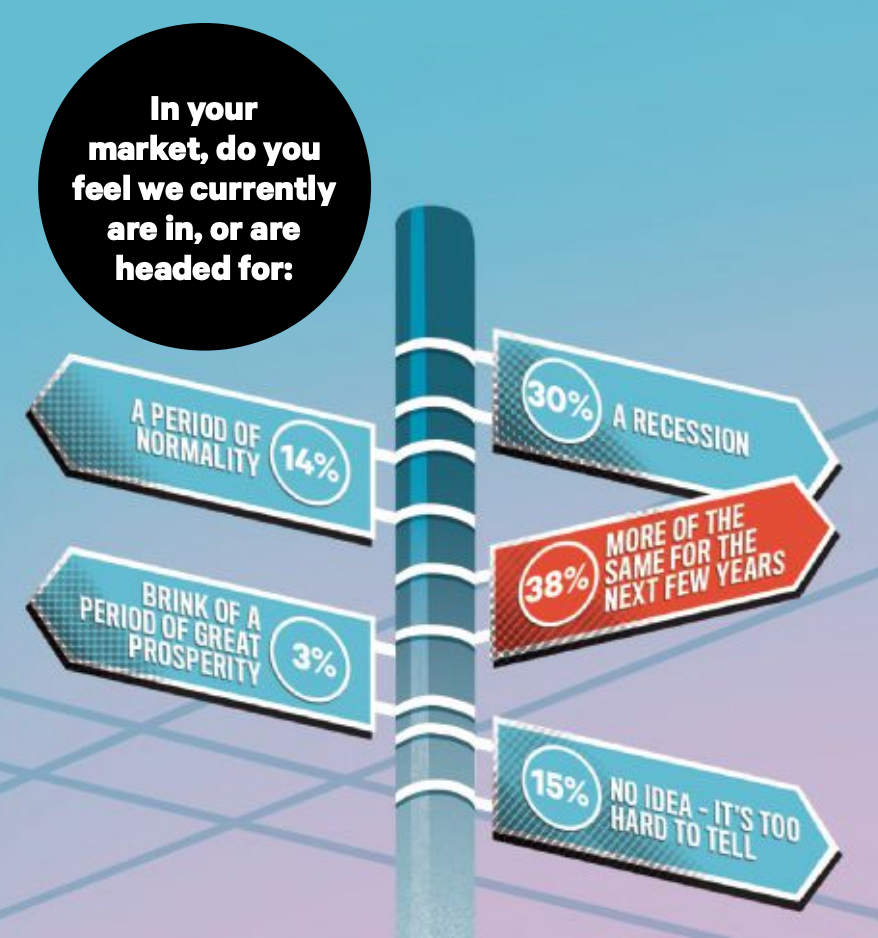

Note: ECPs in the West led the tiny band of bullish respondents with 4% from that region seeing a boom on the horizon, while those in the Midwest were most bearish with 35% seeing a recession ahead. Those in the Southeast were most likely to admit being uncertain — 28% said they had no idea.

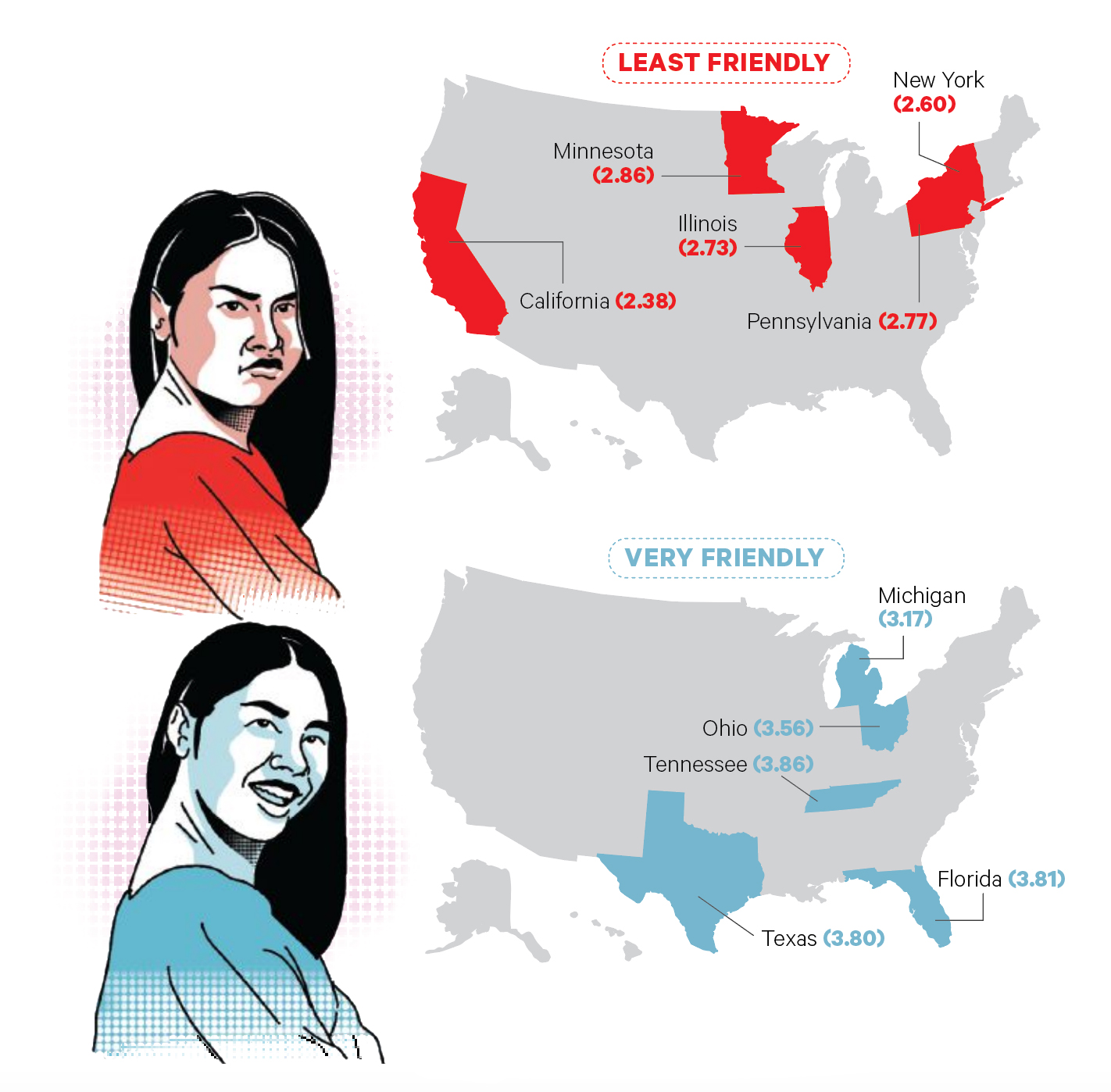

Rate how business friendly your state is on a scale of 1-5?

Note: Figures represent a weighted average. Only states with more than five responses were included.